Access Your Tax Transcript: A Guide to Downloading Form 26AS for ITR Filing

2 May, 2024

One key document that simplifies the process is Form 26AS, also known as your Tax Credit Statement. This document acts as a consolidated record of all your tax-related information, including taxes deducted at source (TDS) and taxes paid directly.

In this guide, we'll break down the simple process of downloading your Form 26AS electronically, saving you time and ensuring a smooth ITR filing experience.

What is Form 26AS?

Form 26AS is a consolidated tax statement that provides a summary of tax-related information such as TDS (Tax Deducted at Source), TCS (Tax Collected at Source), advance tax, and self-assessment tax paid by the taxpayer.

Guide for downloading Form 26AS

Please follow the instructions to download 26AS from the Income tax portal.

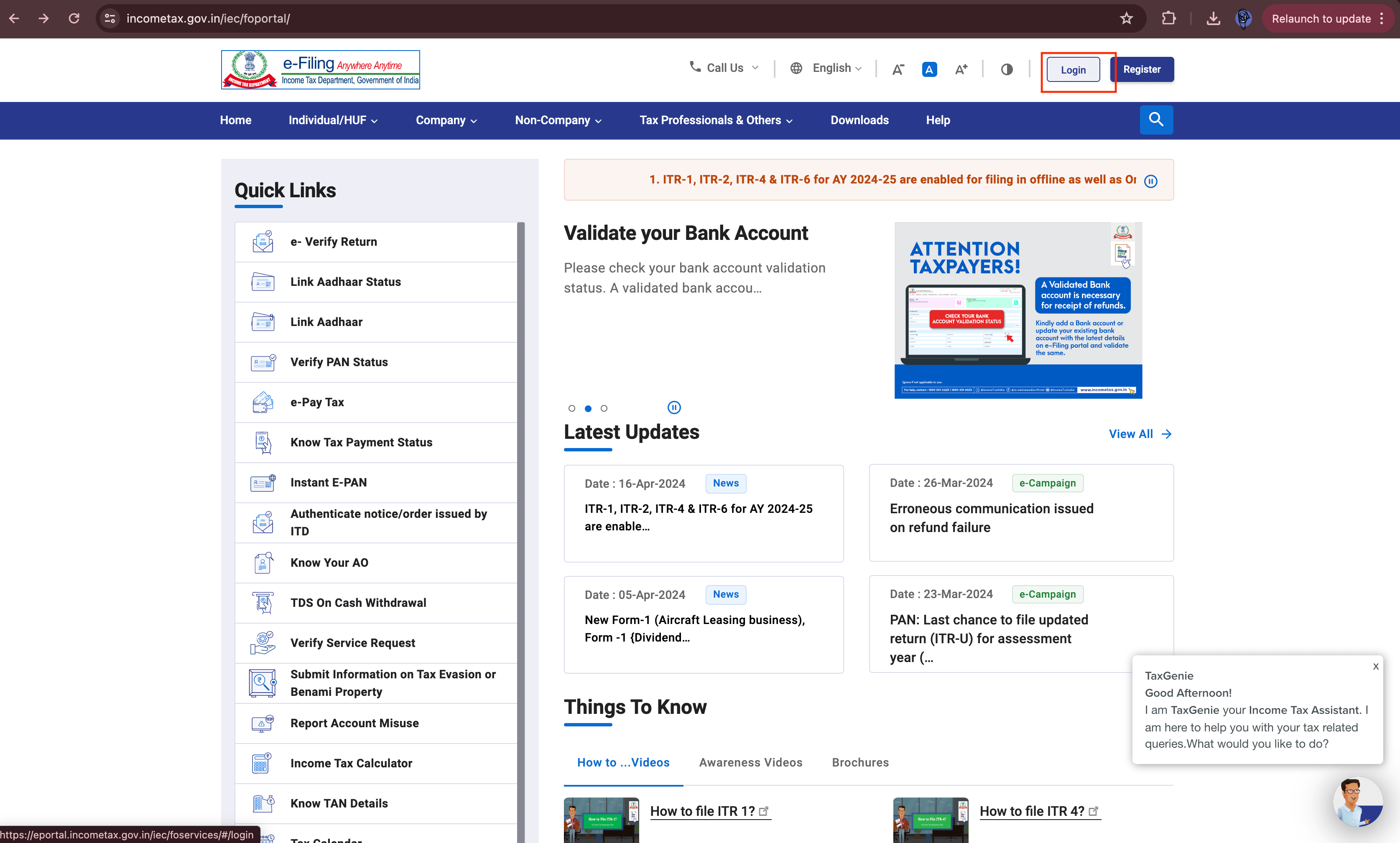

Step 1: Go to the URL https://www.incometax.gov.in/ and select Login if you are an existing user for new user select Register.

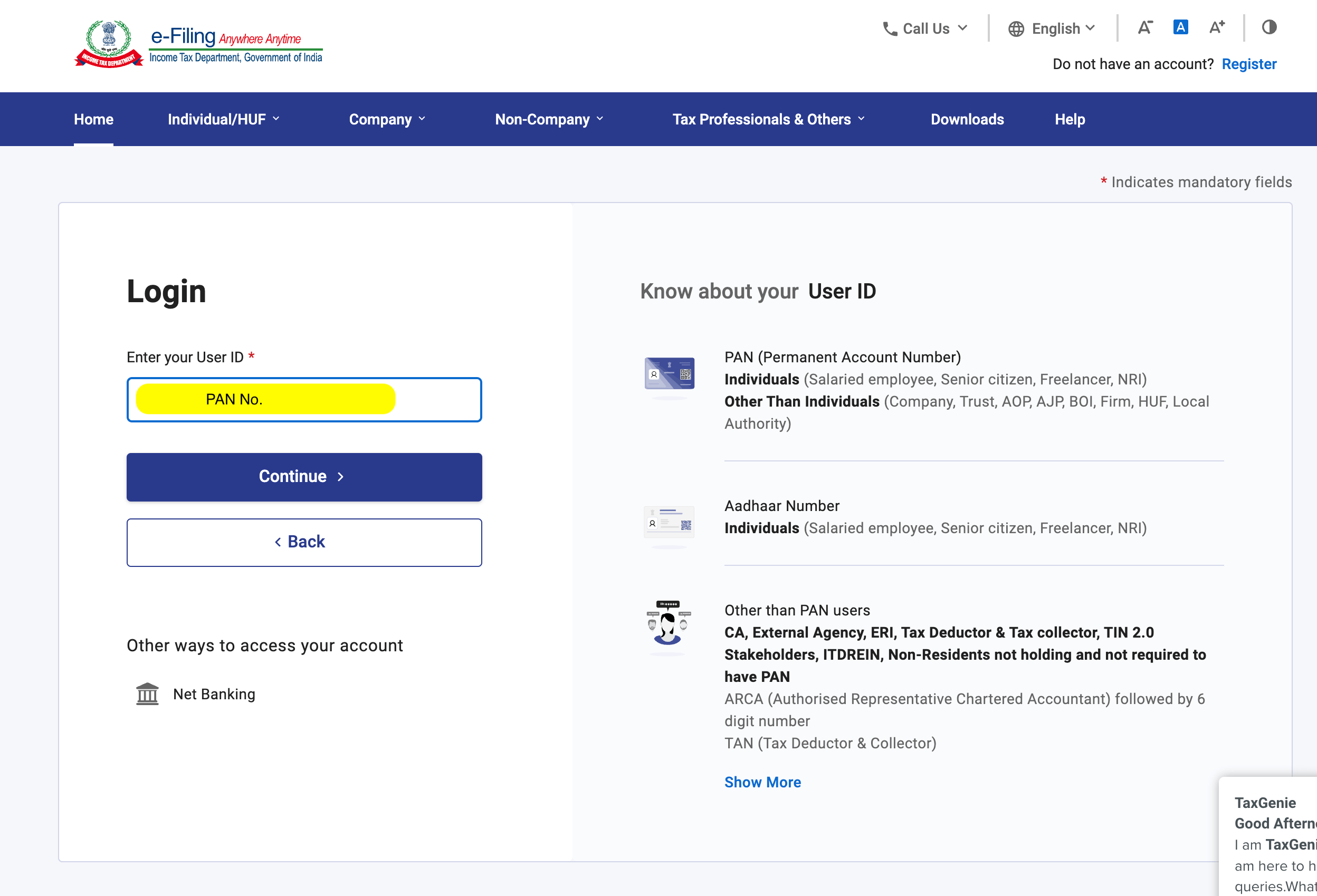

Step 2: Add PAN details and press the Continue button.

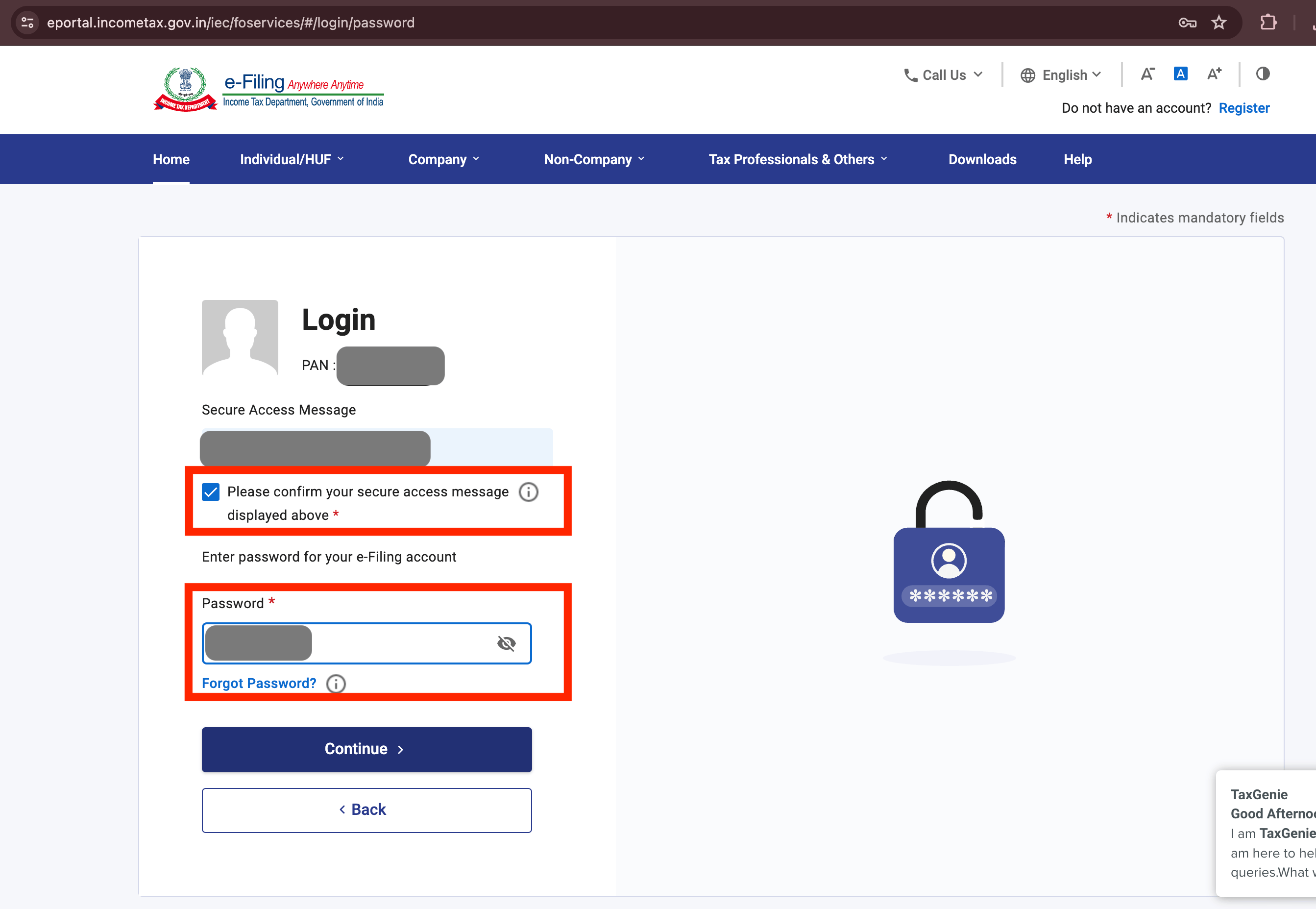

Step 3: Enter the password and tick the box as shown below.

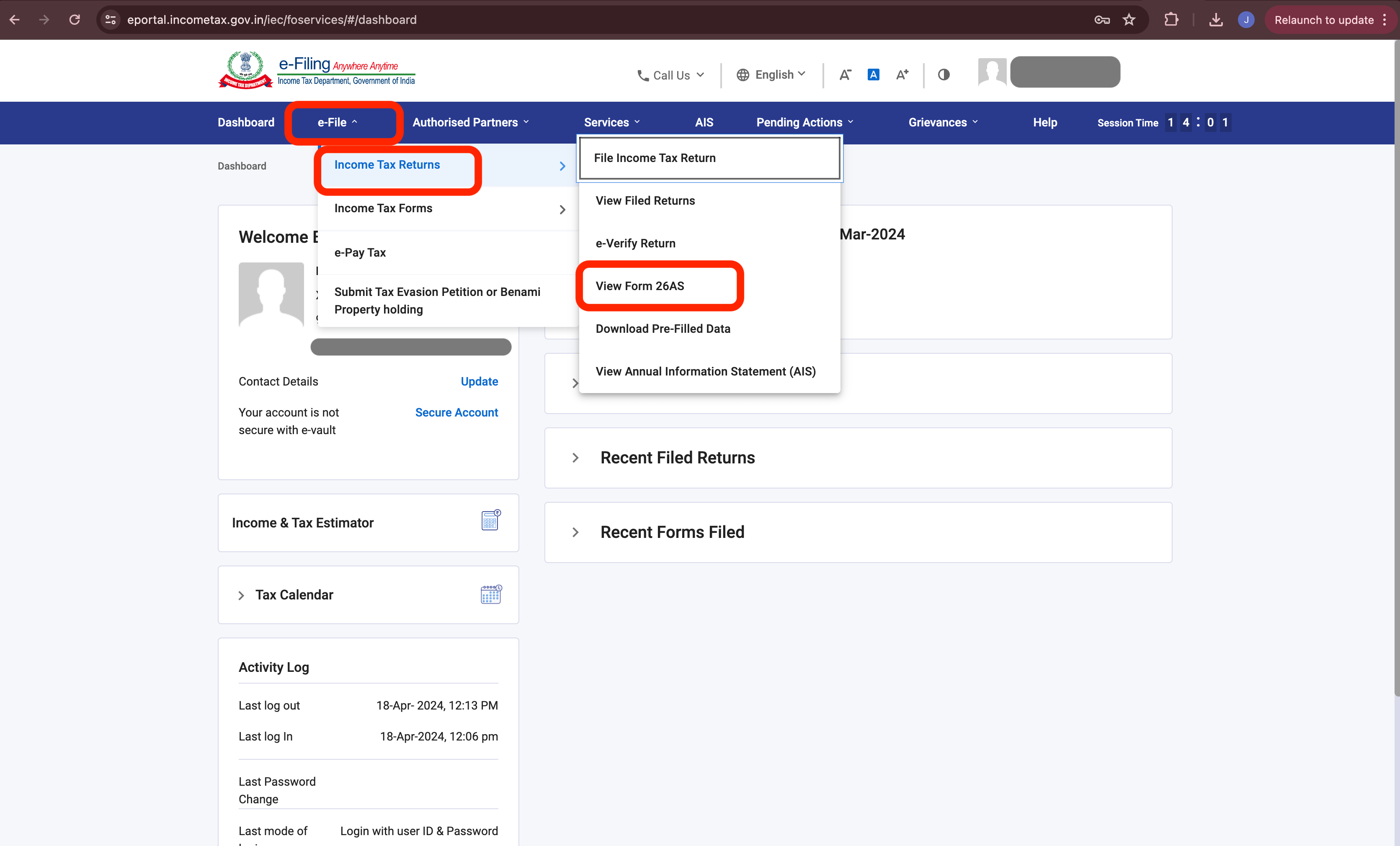

Step 4: Go to E-File option ➡️ select Income Tax Return ➡️ Choose View 26AS.

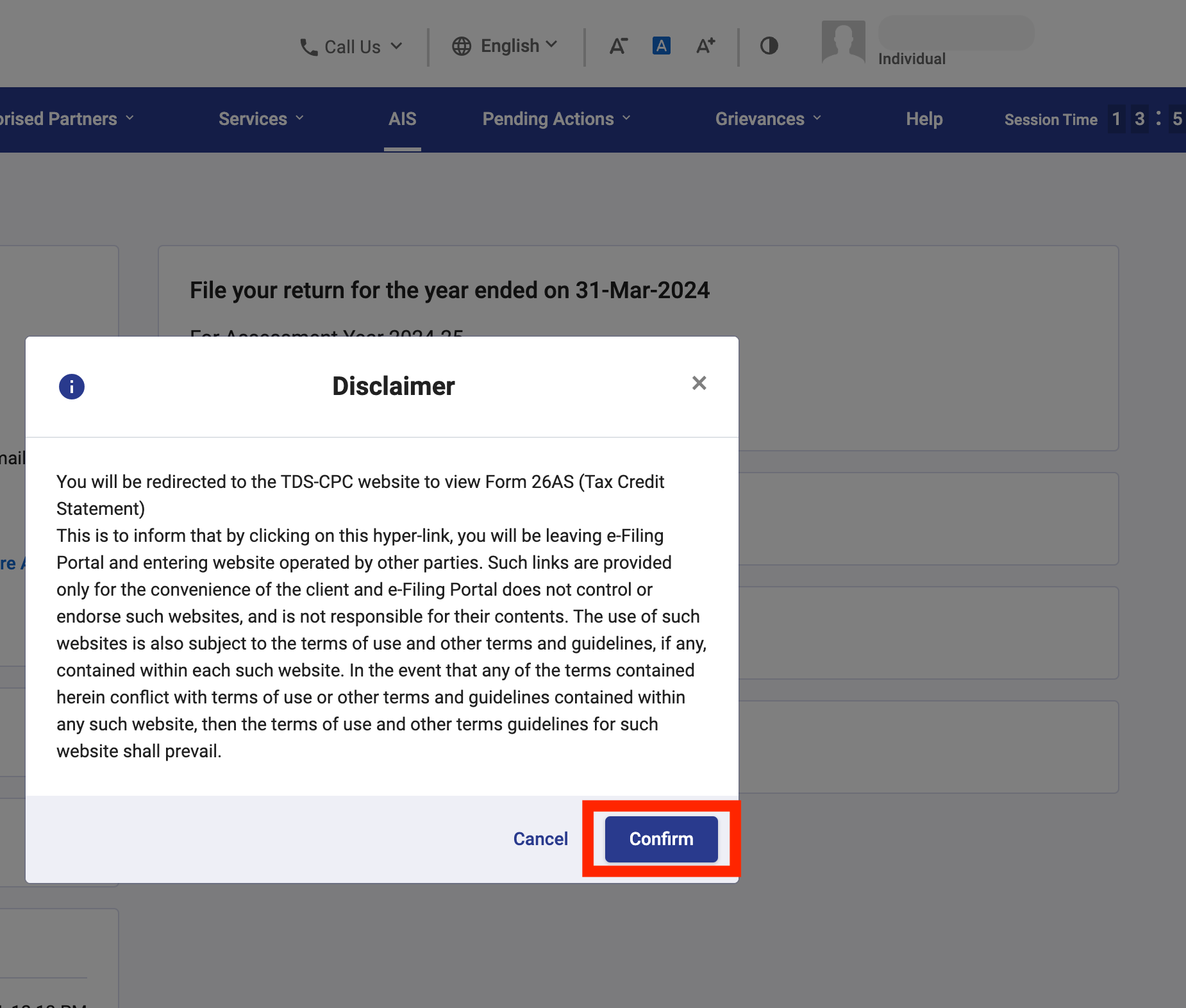

Step 5: Select Confirm to move forward.

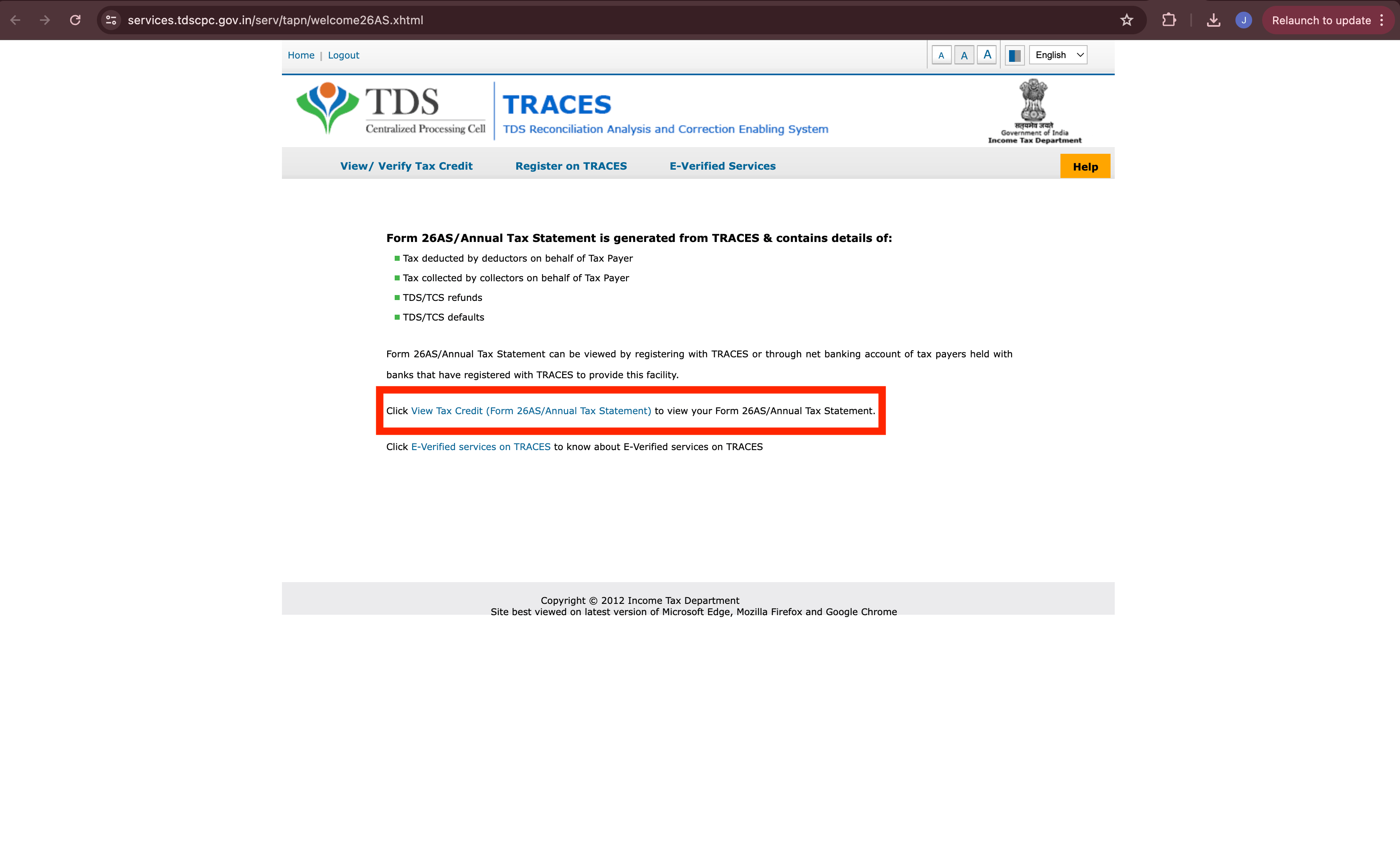

Step 6: Click on View Tax Credit (Form 26AS).

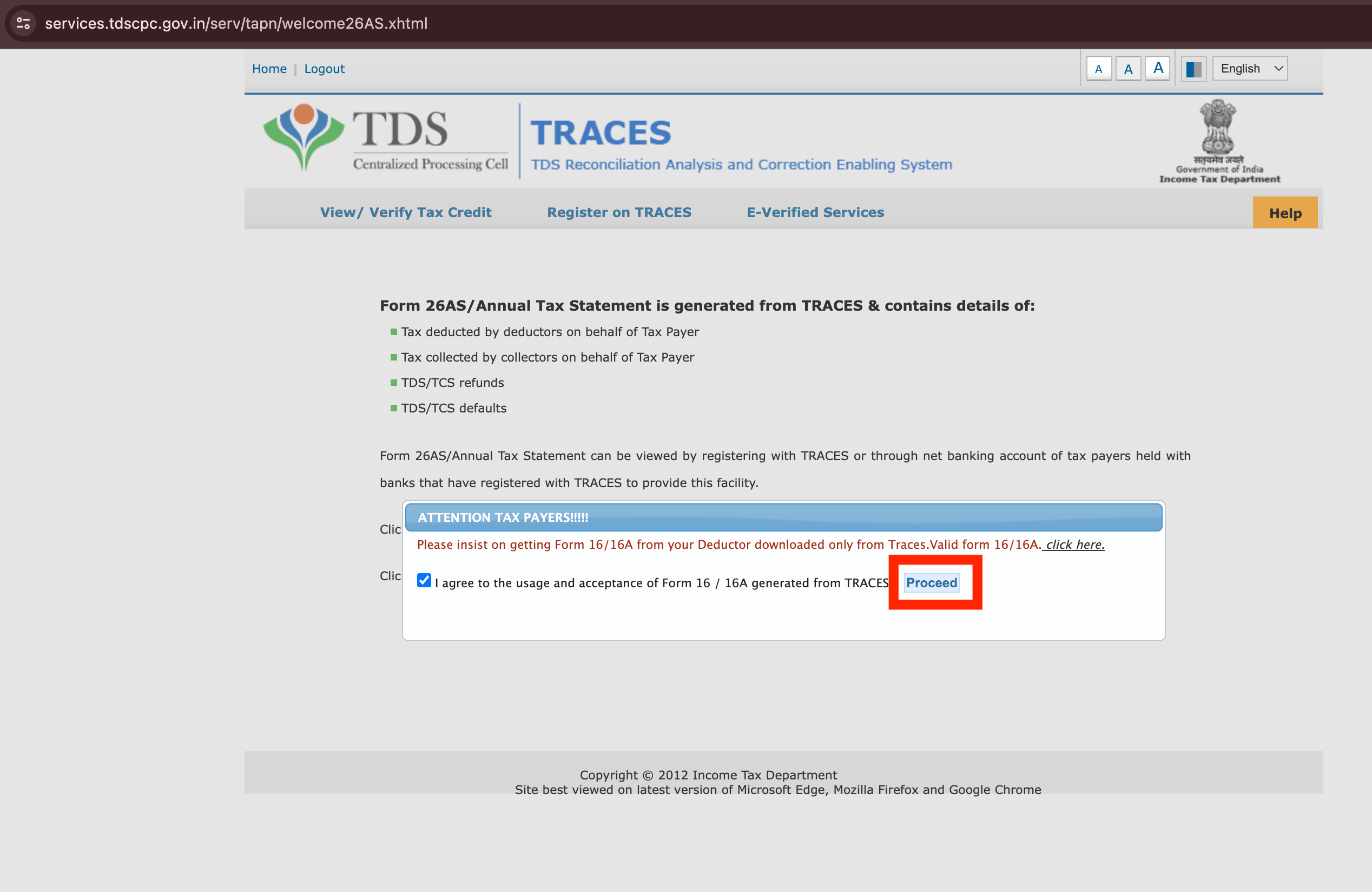

Step 7: Click on the check box and then hit the Proceed button.

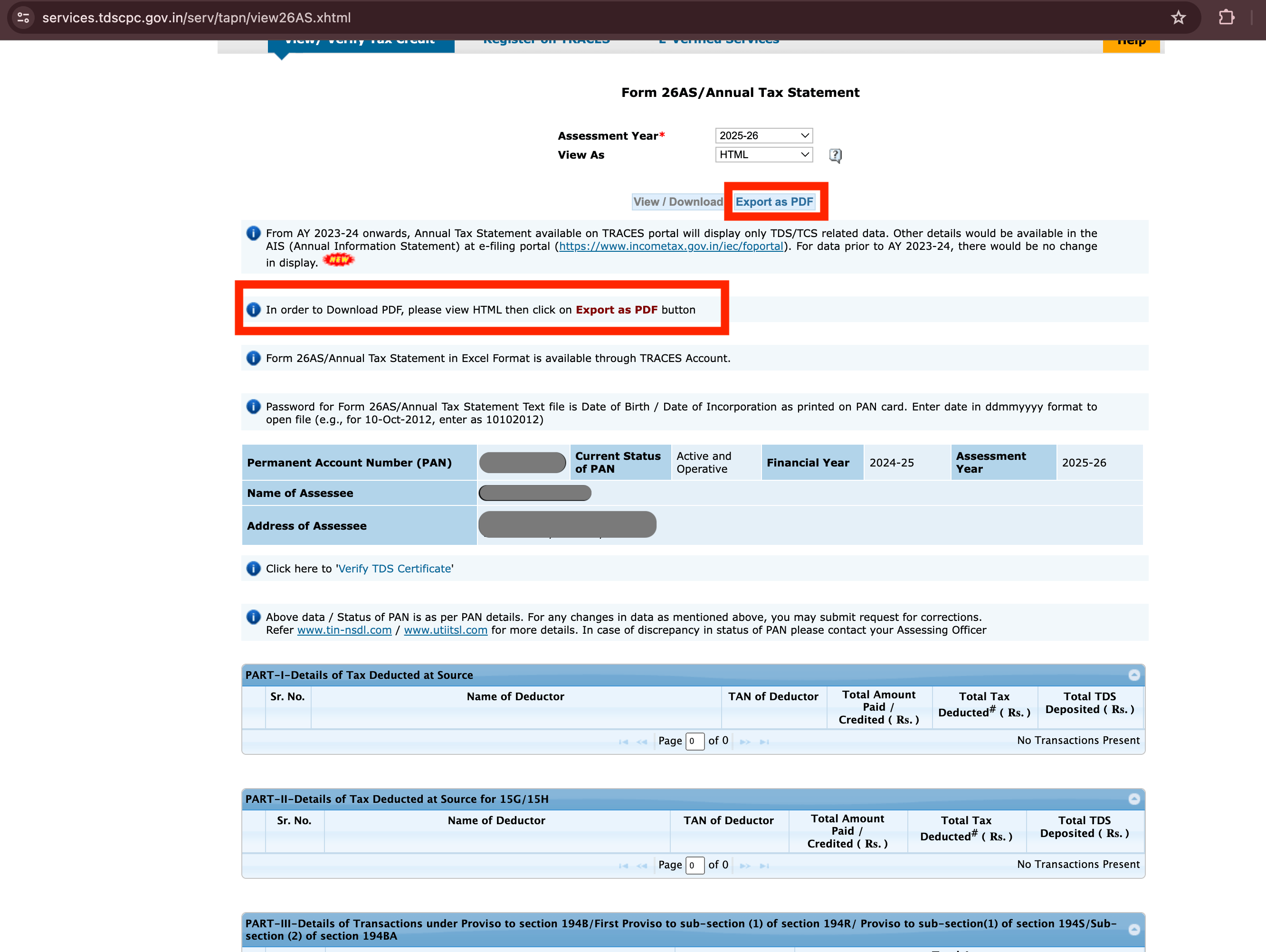

Step 8: To Download 26AS in PDF format select the Assessment Year and HTML format, and then click on View/Download and the click on - Export as PDF as shown below.

Hope that was useful! Please check the guides for downloading:

Access exclusive content and expert tips by subscribing to our newsletter today!

Mool is a leading financial startup that aims to create a sustainable solution for corporate employees by facilitating effective tax planning, smart investments, insurance, and borrowing options. Mool simplifies the personal financial and taxation jargon and makes it accessible to all. With the products of Mool, organizations and employees can now maximize the value of their salaries without a hassle. Mool’s mission is to create a platform to educate everyone, optimize the growth of their money, and empower them with rich facts and proven analysis for decision making.