Amplify Your Finances

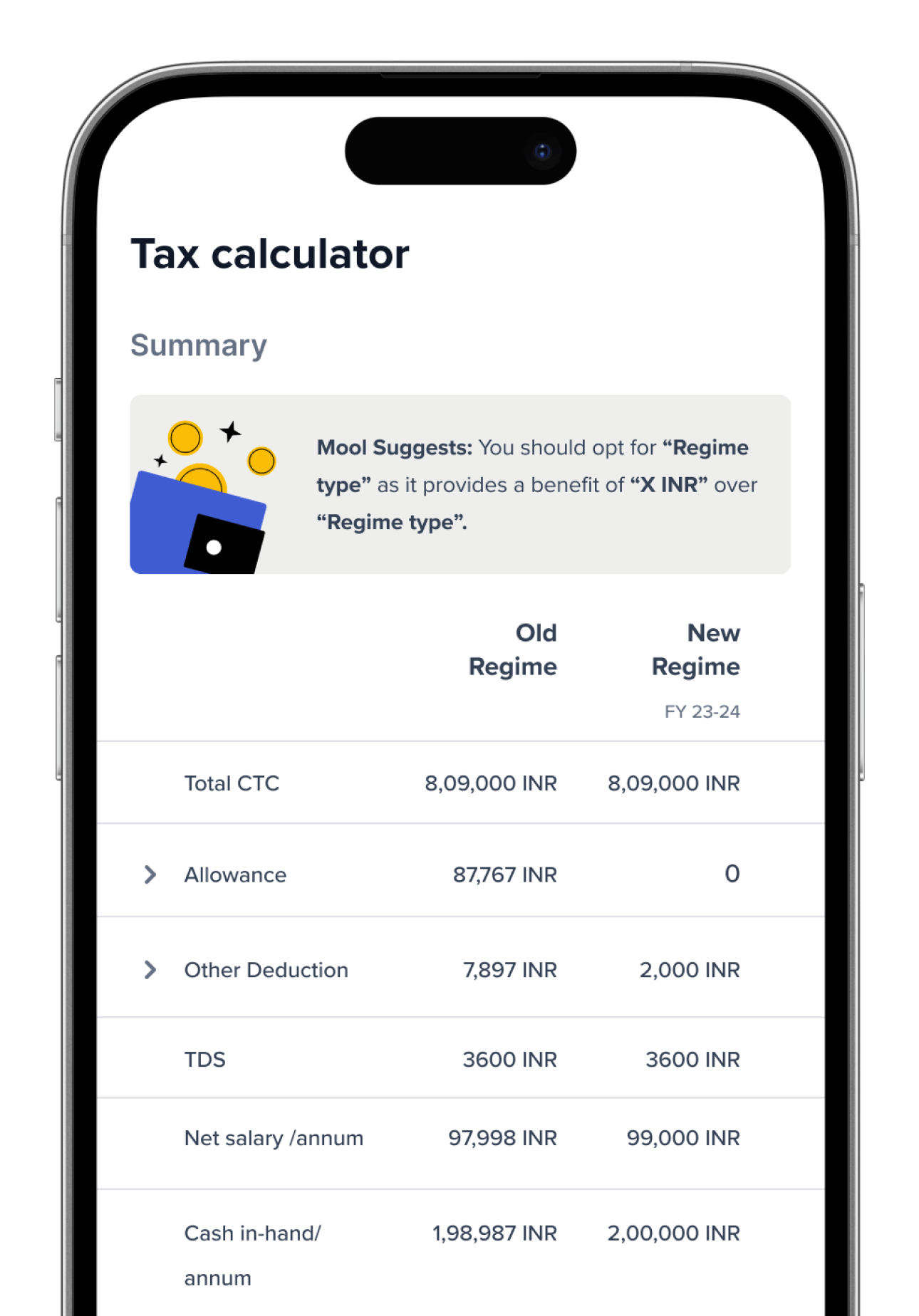

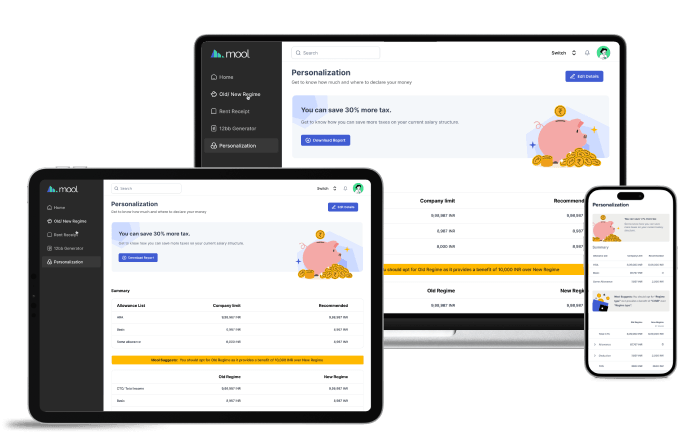

Reduce your tax liability up to 45% with Old vs. New Tax regime calculator. Comprehensive solutions to improve your financial health.

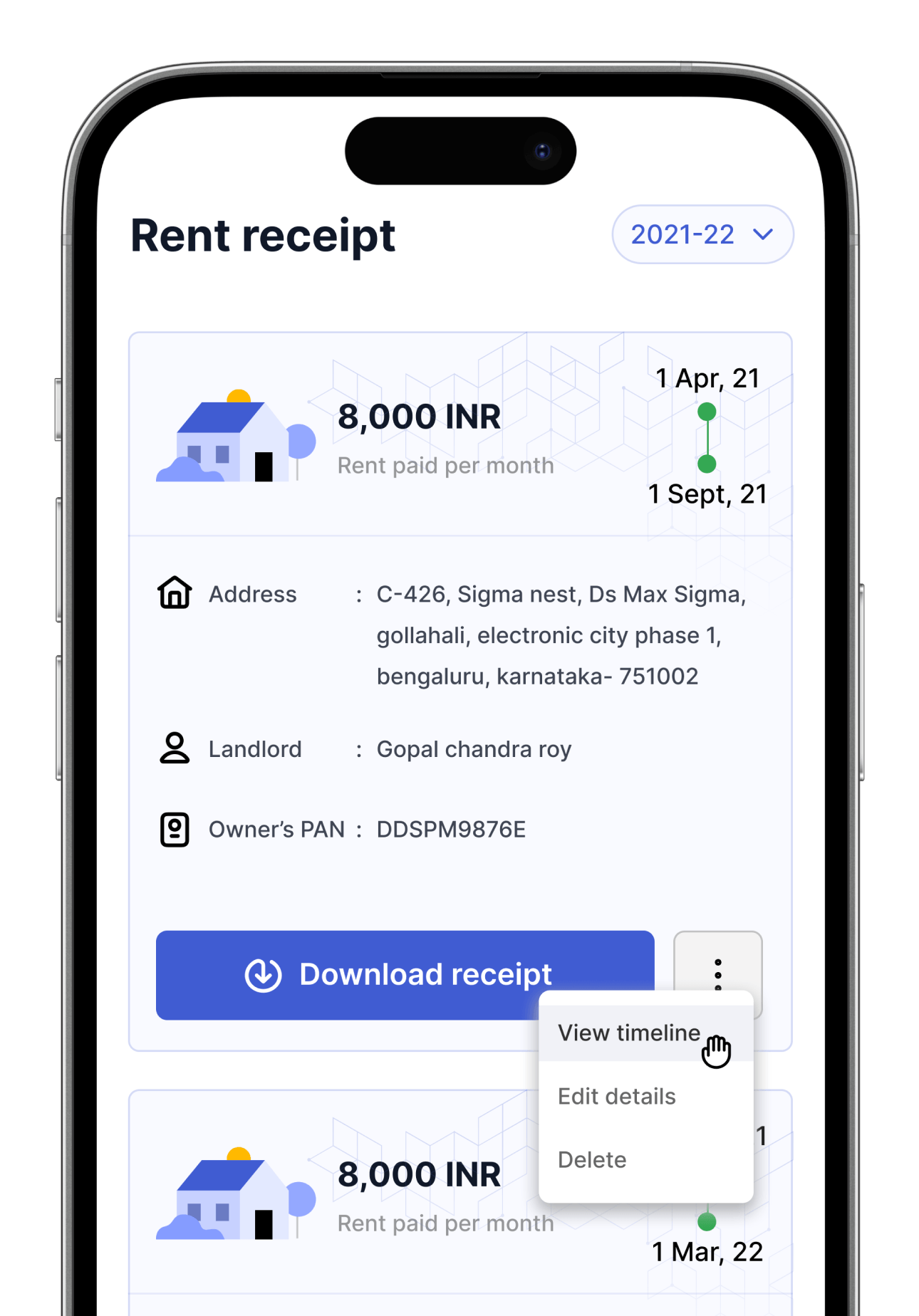

- Personalize your salary to save tax

- File income tax returns online

Salary Optimization at work

While we cannot increase your CTC, we can do the next best thing! Save on your taxes and increase your take home salary.

How it works:

- Smart salary analysis & insights

- Industry benchmarking tool

- Benefits optimization guidance

- Personalized salary recommendations

- Transparent compensation insights

Calculators

All CalculatorsClient Speak

Frequently Asked Questions

Have questions? Find answers here or contact us.

How is Mool Vetan different from other Payroll softwares ?

Mool Vetan is the only solution that offers personalized salary structures for employees, on top of everything else that most payroll software are offering presently. Mool's Personalization Engine is at the heart of everything that Mool Vetan delivers. Be it maximizing savings, take-home salary, or other employee benefits.

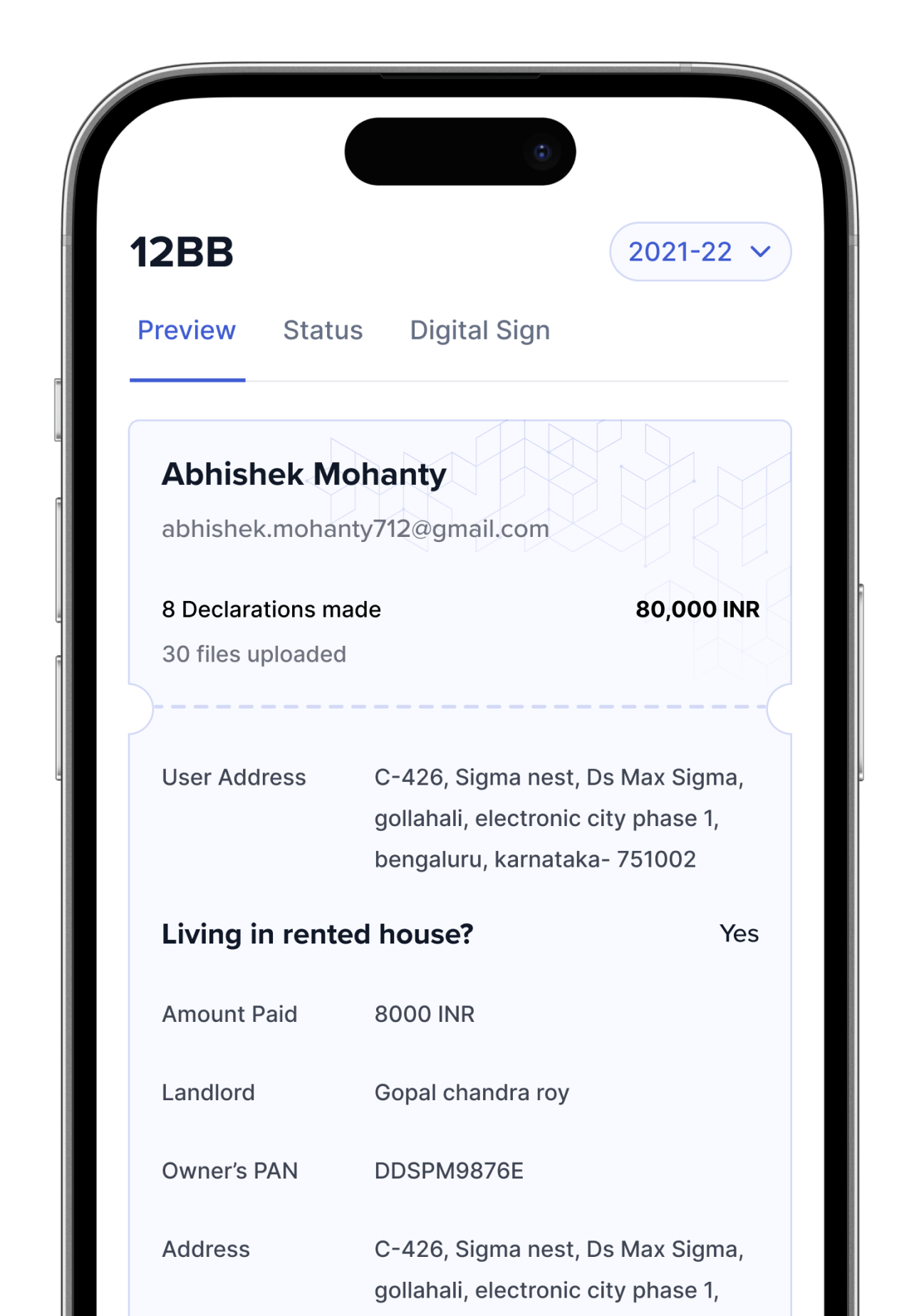

What is Mool's salary personalization?

Mool’s salary personalization is a unique feature that takes inputs from the employees about their spending and generates a tax-optimized structure best suited for that particular individual.

Does Mool Vetan generate compliance reports?

Yes! Mool generates state-wise compliance reports after the payroll is processed. In fact, Mool Vetan compliance audit feature is up-to-date with the Wages Act and Labor Laws across India.

Are TDS calculation on Perquisites (Perks) available in Mool Vetan?

Yes! TDS calculations for perquisites are a part of Mool as per the Income Tax laws. We understand the importance of perquisites for an employee and employer.

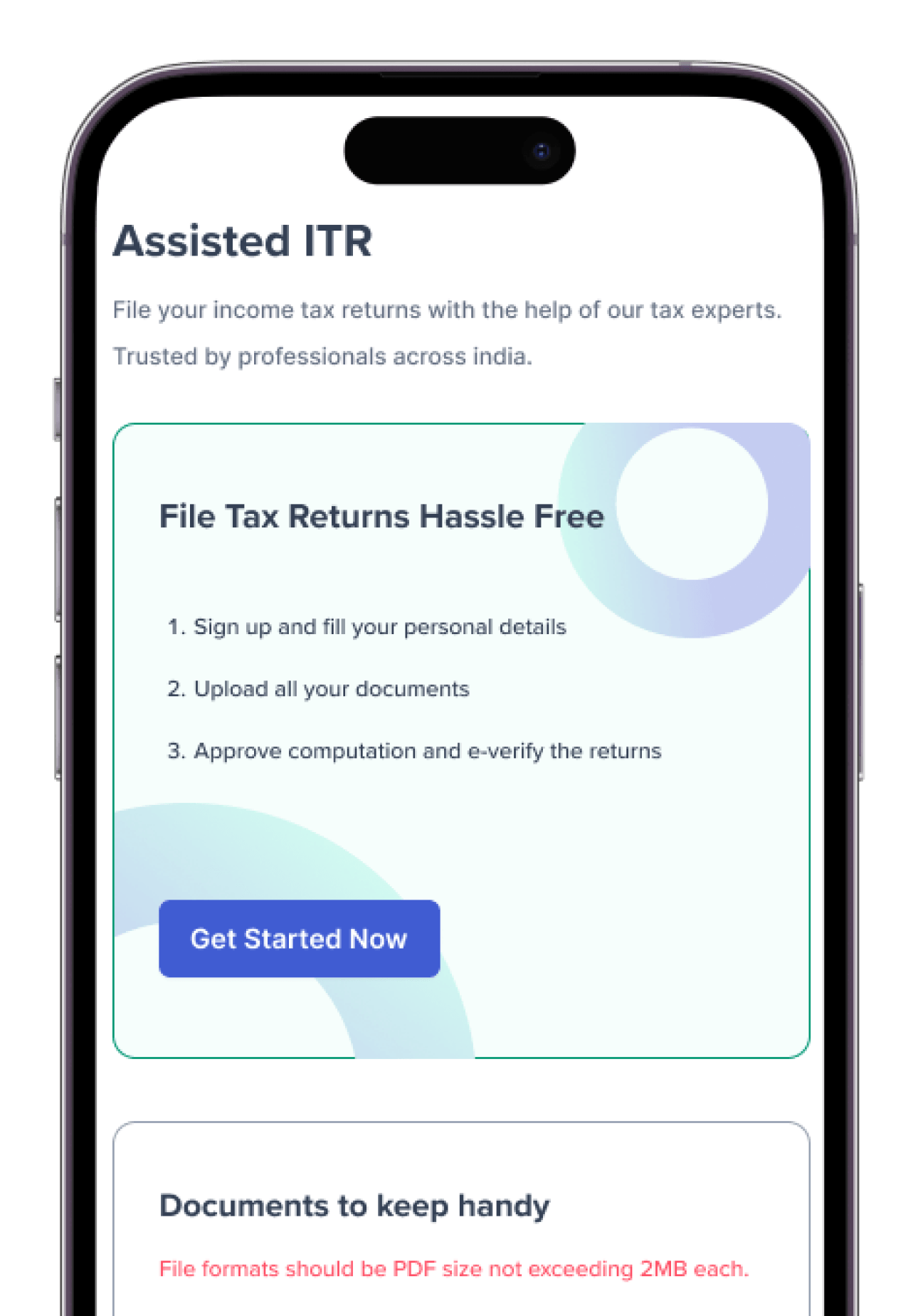

Does Mool provide IT Return filing service ?

Yes, Mool offers assisted ITR ( Income Tax Return ) filing services for Individuals. A user can register with us and upload all the necessary documentation. With the help of our Tax Experts, your IT Returns are prepared and filed online.

When can I start filing IT Returns through Mool?

You can start filing your Income Tax Return through Mool anytime. Currently, the deadline for filing returns without penalty is over for FY 2022-23. However, you can register and create account with us for FY 2023-24. Soon, we will allow you to store your documents and investment proofs online and when the returns filing season opens up for AY 2024-25, you can start the filing process.

Where can I find step by step process of filing ITR ?

You can read through our blogs and articles where we have explained the step by step process of filing ITR online. Else, you can create an account with us and through an easy process and video guide, you can file your ITR. We also provide assisted ITR service. You can get in touch with us and with the help of a tax expert, we can help you file the IT Returns.

What other services and products does Mool offer?

Mool is a comprehensive SaaS platform offering personalized tax and financial planning solutions to individuals and enterprises. We provide various SaaS based services including Income Tax Filing and Tax & salary planning for individual taxpayers; Employee Payroll Automation, Salary Personalization and Compliance Audit for Enterprises and Client management platform for Tax Experts and finance professionals.