Numbers Don't Lie

Experience the future of HR with Mool Vetan

Organizations are embracing digital transformation of HR systems to become future-ready. Unlock new efficiencies and opportunities with real-time data and personalized solutions.

One-stop Solutions

Offer salary personalization, process payments, and streamline HR operations from one login. Choose from a rich feature set and configure as required by your business.

Fully Compliant

Stay 100% compliant with state and central labour and tax laws. Ensure adherence to local tax laws including but not limited to PF, ESI, PT and other statutory regulations.

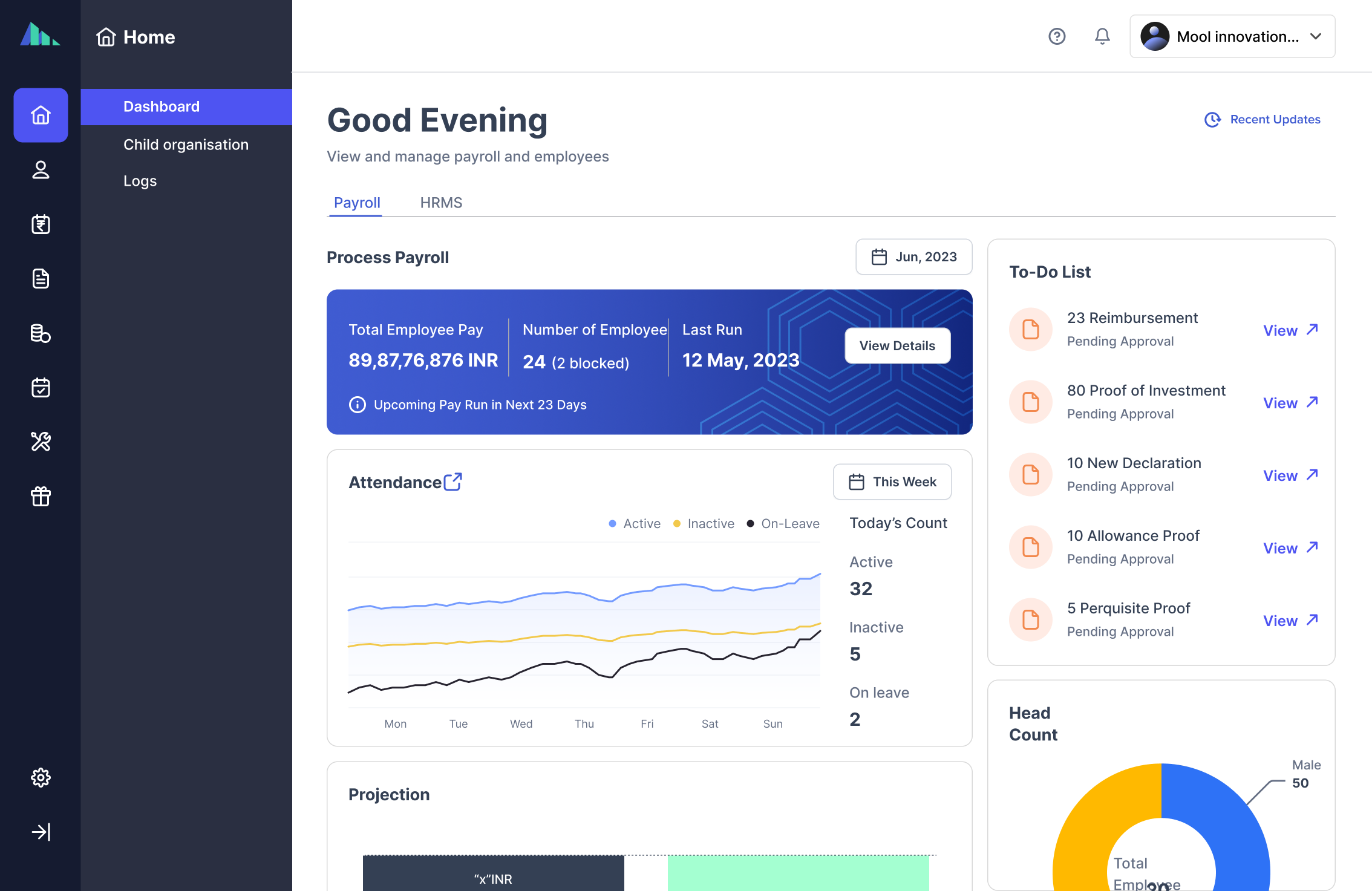

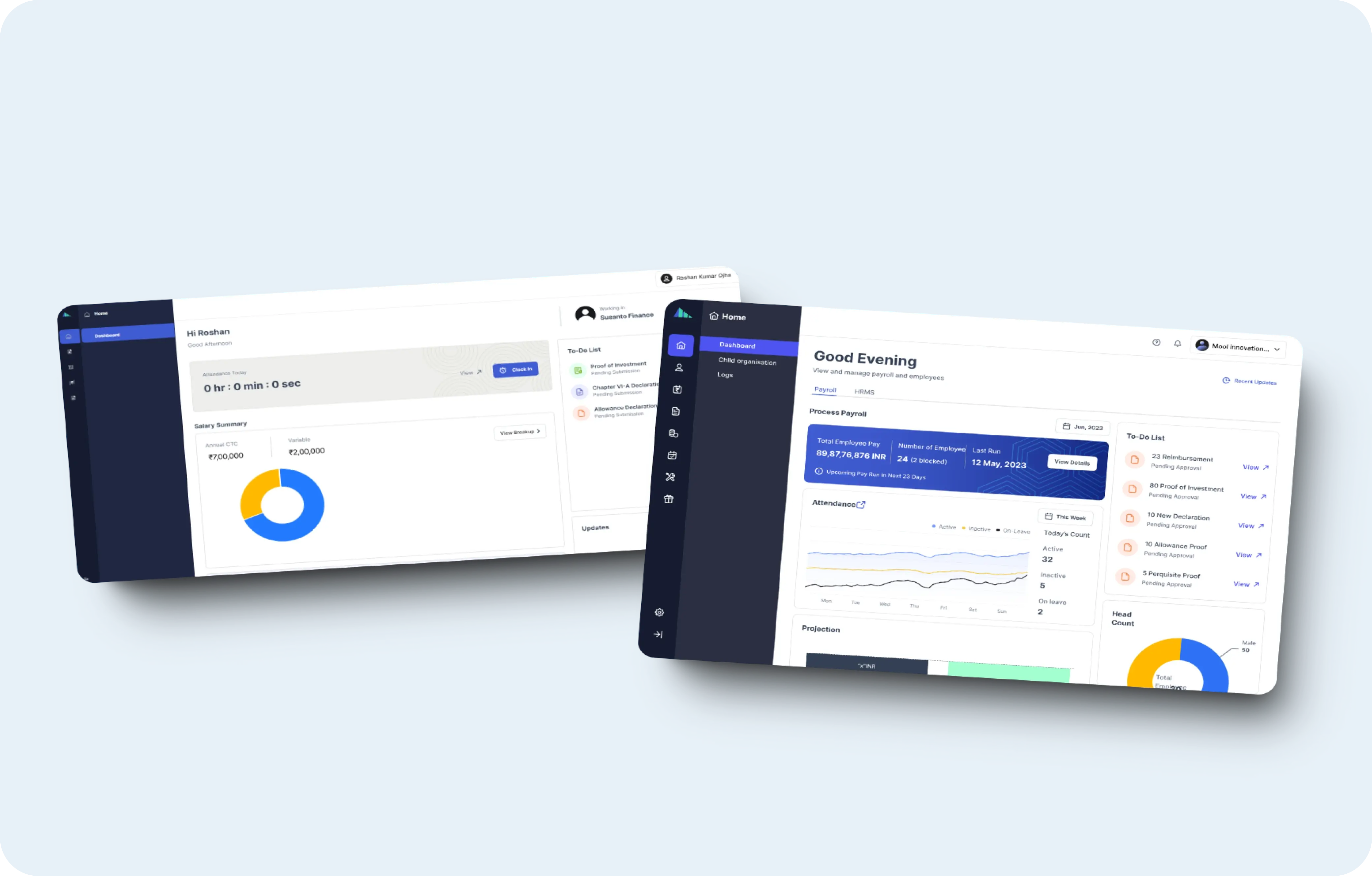

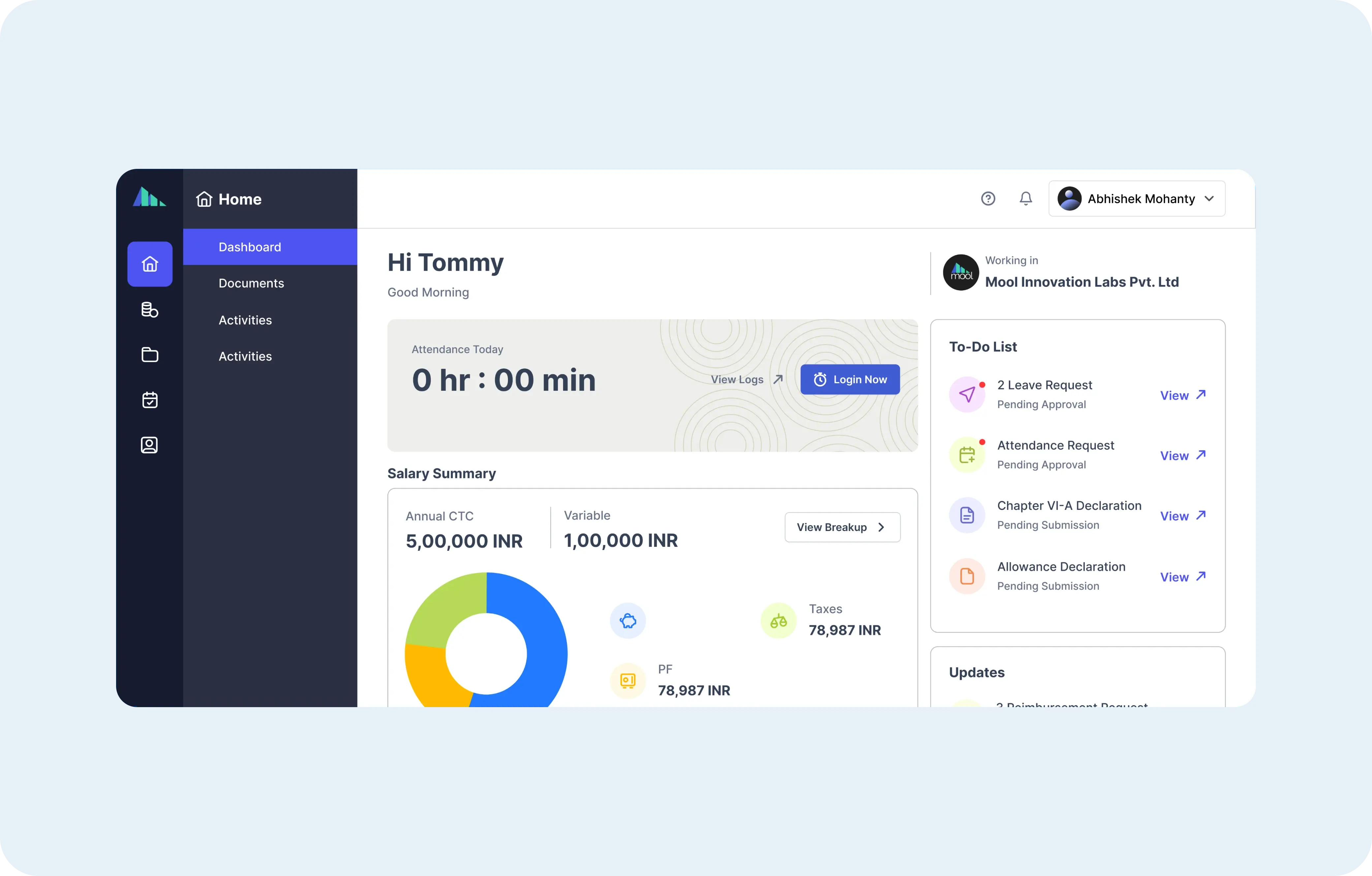

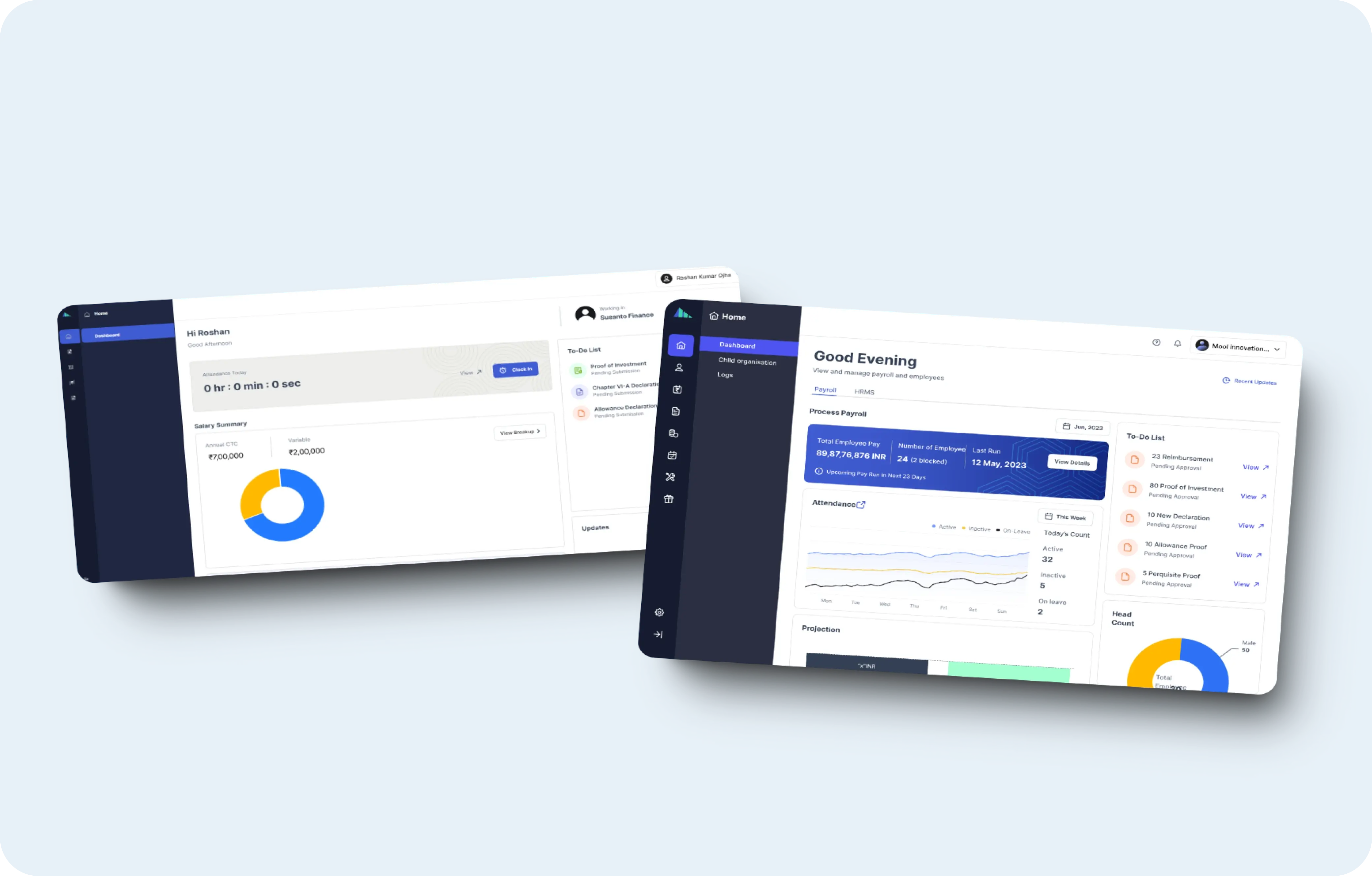

Unified Dashboards

Gain 360-degree visibility on all HR activities with real-time data access. Protect sensitive data with AWS promise and role-based access control.

Built-in Automations

Boost efficiency with automated CTC calculators and payroll processing. Reduce manual workload without compromising on data integrity and accuracy.

Integration Capabilities

Integrate with your existing salary management system, ERP, or accounting software. Seamlessly scale your business with cloud support.

User-Friendly Interface

Ensure effortless onboarding and minimal staff training with intuitive design. Achieve results faster with quicker adoption and easier product navigation.

Costs lesser than your

coffee budget

Salary personalization and added perks are a clear win-win for employers and employees. Employers have the chance to skyrocket employee satisfaction without exceeding the CTC budget.

For Employer

Motivate and reward your employees without breaking the bank

Stay within your CTC budget

Retention boost

Reduced attrition

Employee self service

Better admin efficiency

For Employees

Mastering finances with better control of salaries and taxes

More freedom and choice with money

Increased take-home salaries

Increased satisfaction

Improved tax planning

Tax-optimized perquisites

Salary Personalization with Full-Suite HRMS and Payroll

CTC Optimization

Hire and retain the best talent by offering personalized CTC structures. Make hassle-free monthly payouts customized for each employee.

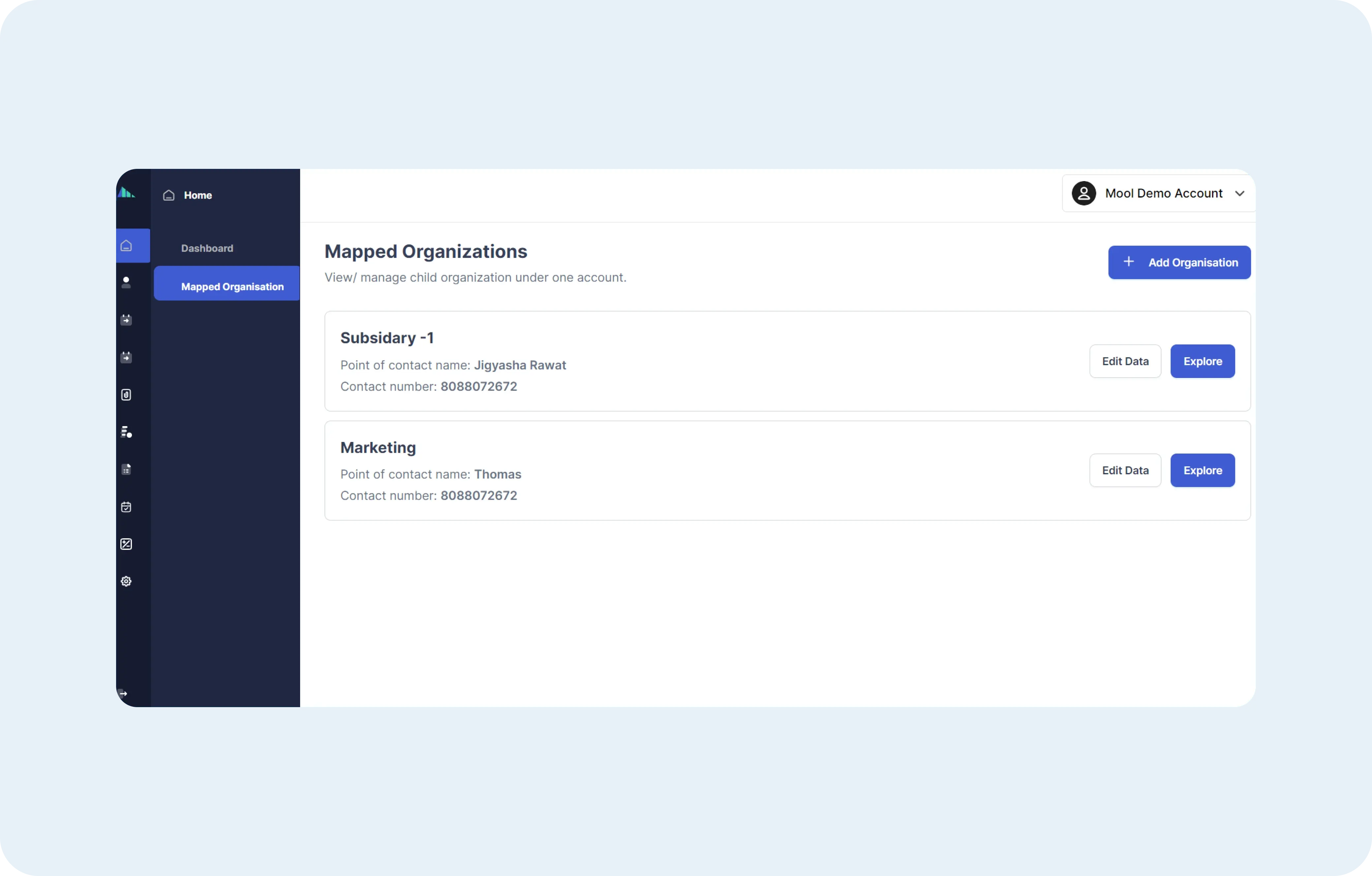

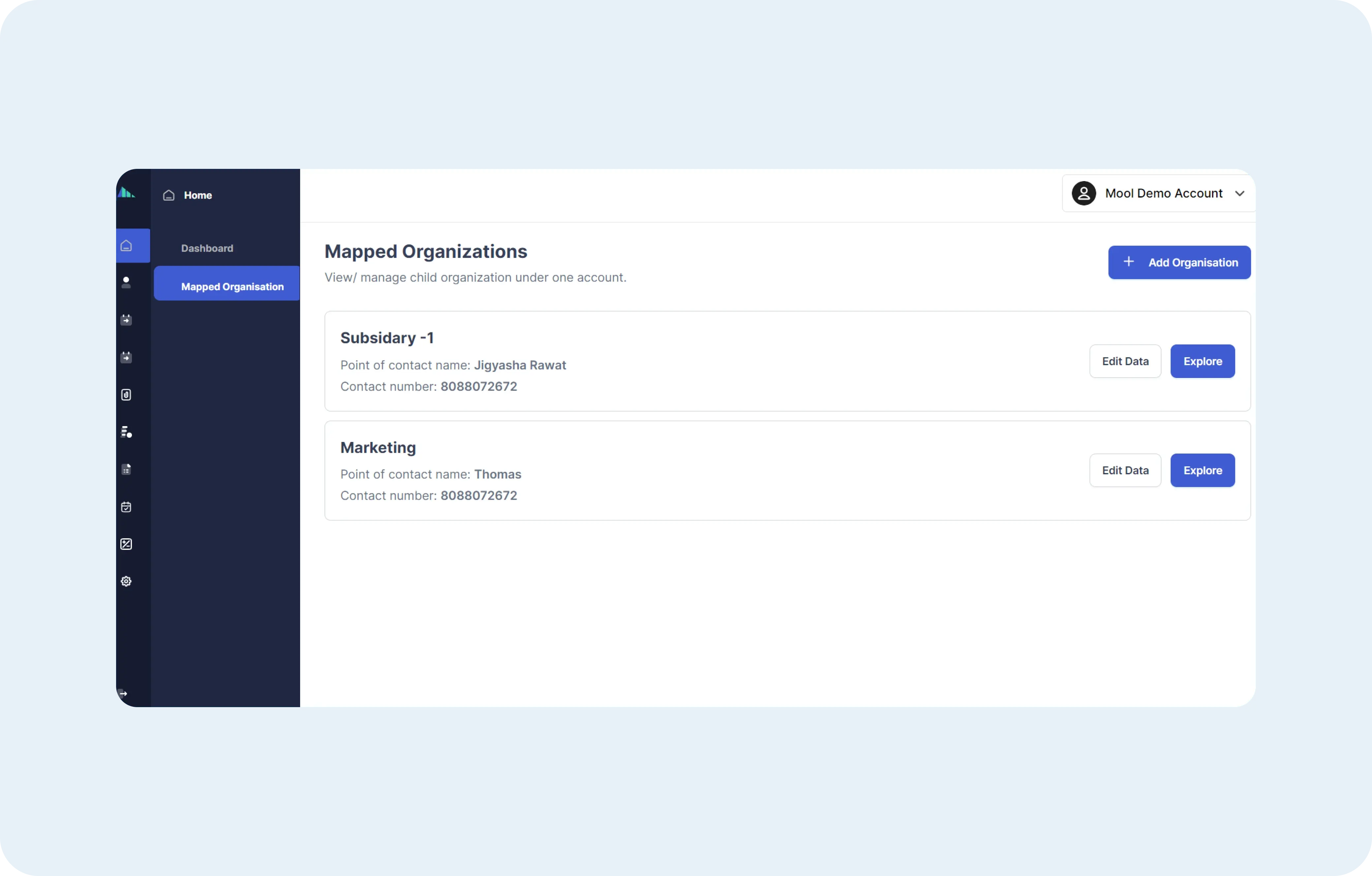

Child Organizations

Get centralized visibility into HR and payroll activities of child organizations and branches. Grant credentials and offer smoother management via one master account.

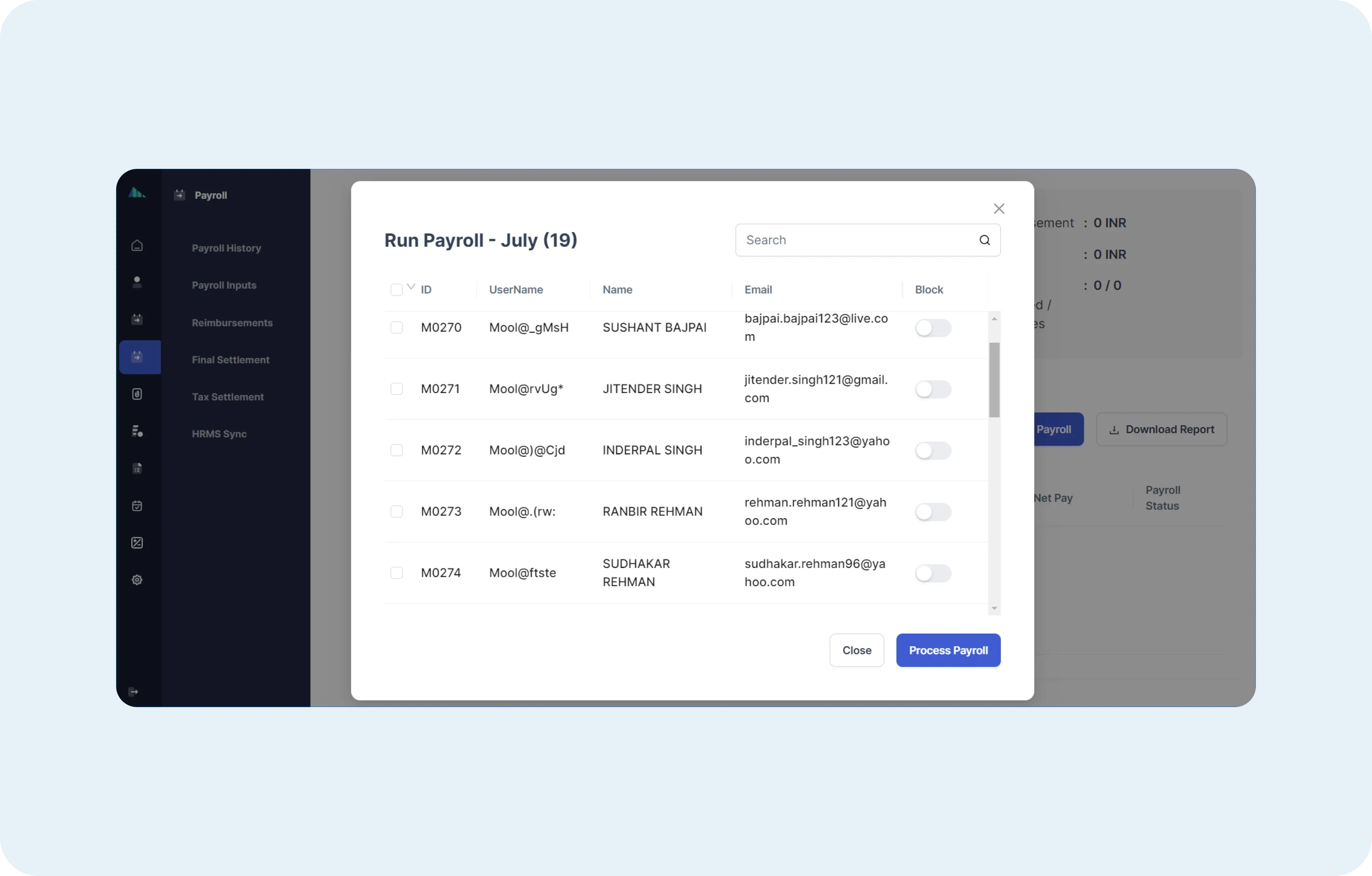

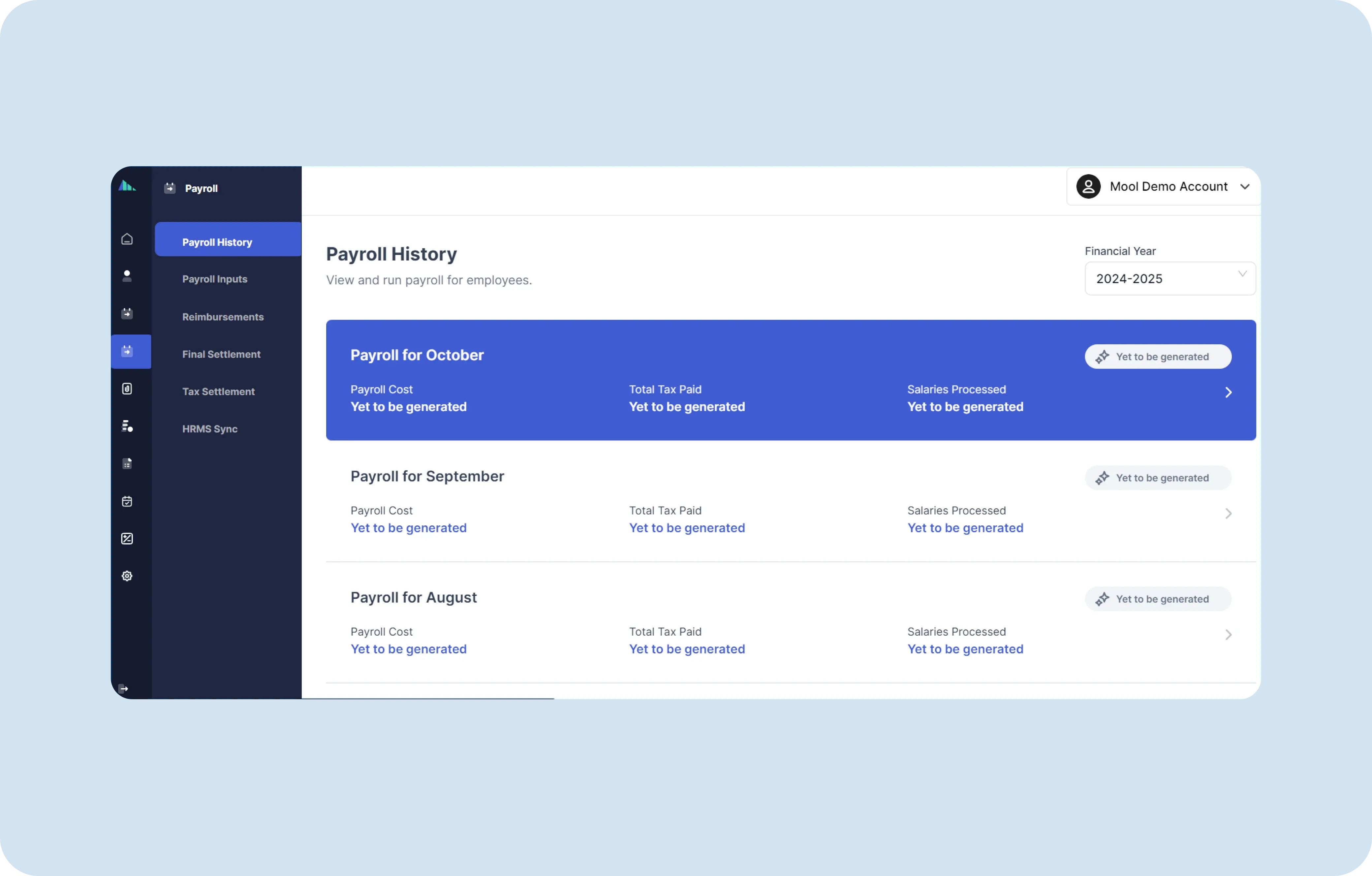

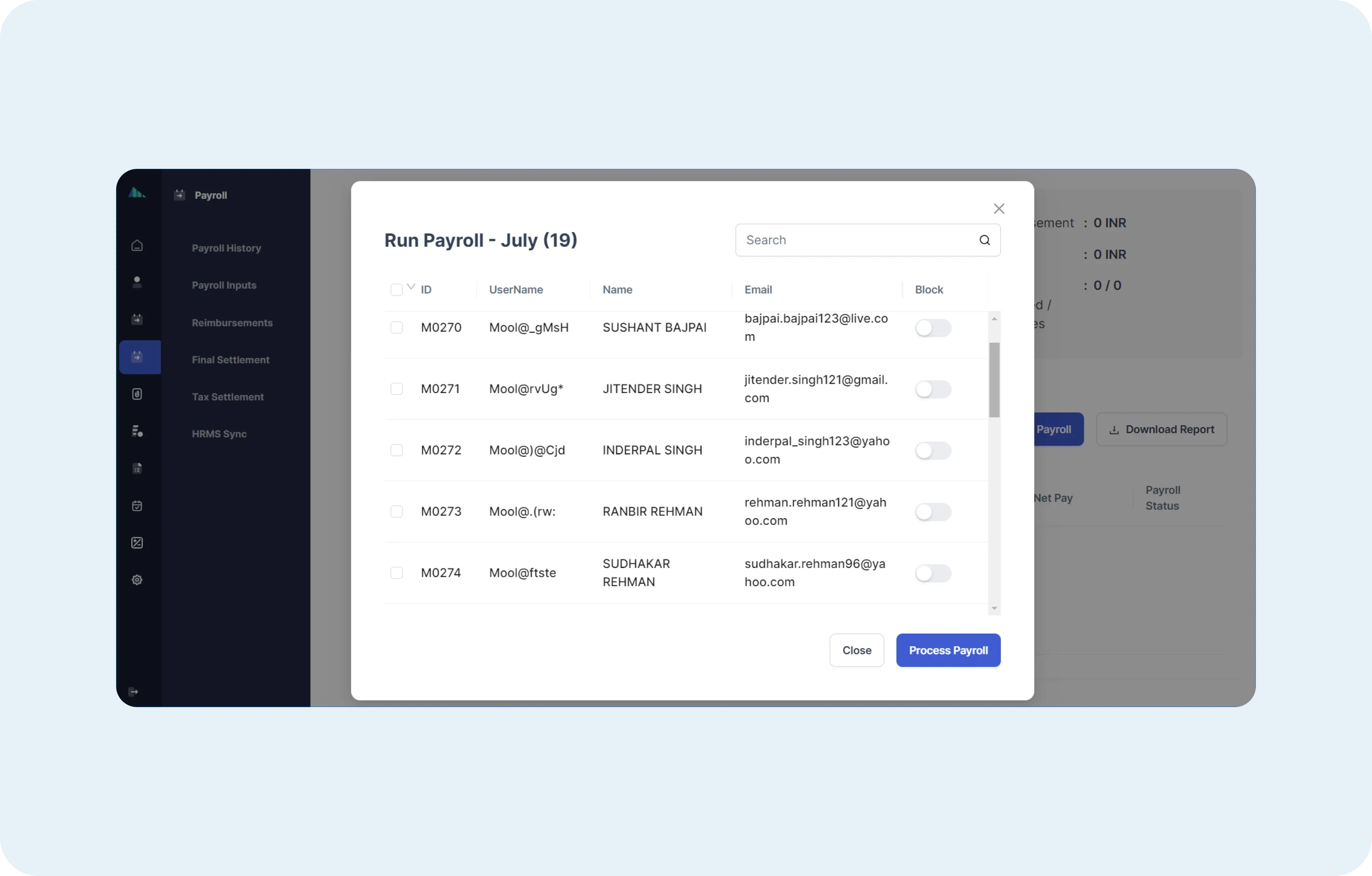

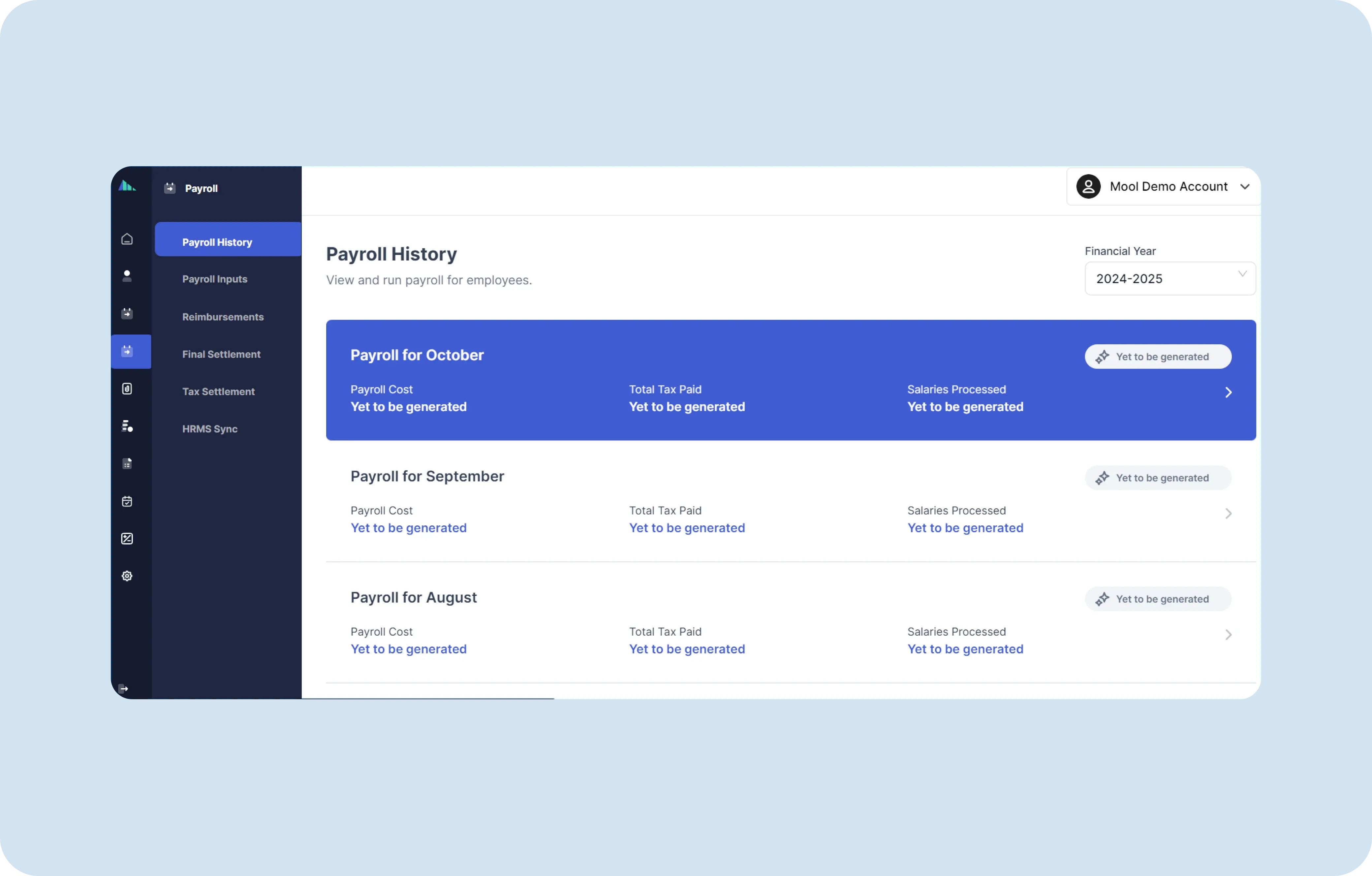

Payroll Management

Process payroll, reimbursements, tax and F&F settlements. Sync HRMS data on one click and make timely and accurate payment processing.

Role-Based Access Control

Grant separate access to Mool Vetan modules for controlled access to sensitive information. Seamlessly manage payroll, finance, and HR operations via permissions.

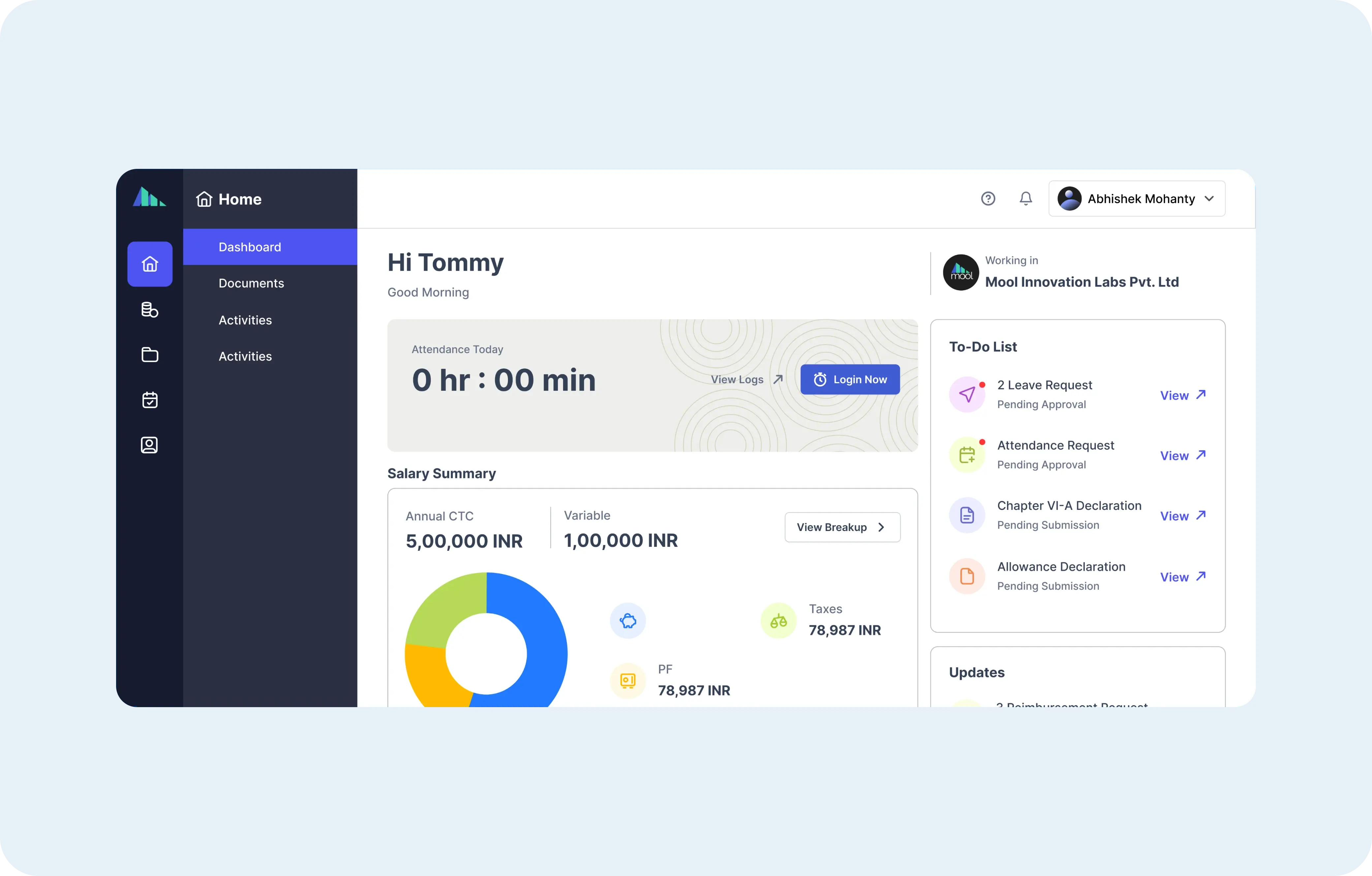

Employee Self-Service

Empower employees with self-service portal for tax documents, payslip access, and leave planning. Foster a culture of trust with increased transparency.

CTC Optimization

Hire and retain the best talent by offering personalized CTC structures. Make hassle-free monthly payouts customized for each employee.

Child Organizations

Get centralized visibility into HR and payroll activities of child organizations and branches. Grant credentials and offer smoother management via one master account.

Payroll Management

Process payroll, reimbursements, tax and F&F settlements. Sync HRMS data on one click and make timely and accurate payment processing.

Role-Based Access Control

Grant separate access to Mool Vetan modules for controlled access to sensitive information. Seamlessly manage payroll, finance, and HR operations via permissions.

Employee Self-Service

Empower employees with self-service portal for tax documents, payslip access, and leave planning. Foster a culture of trust with increased transparency.

Suitable for companies of all sizes

Startups

Focus on your business growth. Leave the best configuration for small businesses up to us.

What you get:

- CTC Calculator

- Salary Personalization

- Leave & Attendance

- Employee Onboarding

- Pay-out Management

SMEs/MSMEs

Streamline HR processes by centralizing employee customization options, providing a diverse range of choices to foster employee satisfaction and engagement.

What you get:

- Compliance Audit

- TDS Computation & Filing

- All Tax-planning Calculators

- CTC Calculator

- Salary Personalization

- Leave & Attendance

- Employee Onboarding

- Pay-out Management

Enterprises

Vetan is built for scale and enterprise customers get customized solutions focused on salary personalization and employee retention.

What you get:

- Dedicated Account Manager

- Personalized Compensation Design

- Compliance Audit

- TDS Computation & Filing

- All Tax-planning Calculators

- CTC Calculator

- Salary Personalization

- Leave & Attendance

- Employee Onboarding

- Pay-out Management

Client Speak

Frequently Asked Questions

Have questions? Find answers here or contact us.

How is Mool Vetan different from other Payroll softwares ?

Mool Vetan is the only solution that offers personalized salary structures for employees, on top of everything else that most payroll software are offering presently. Mool's Personalization Engine is at the heart of everything that Mool Vetan delivers. Be it maximizing savings, take-home salary, or other employee benefits.

What is Mool's salary personalization?

Mool’s salary personalization is a unique feature that takes inputs from the employees about their spending and generates a tax-optimized structure best suited for that particular individual.

Does Mool Vetan generate compliance reports?

Yes! Mool generates state-wise compliance reports after the payroll is processed. In fact, Mool Vetan compliance audit feature is up-to-date with the Wages Act and Labor Laws across India.

Are TDS calculation on Perquisites (Perks) available in Mool Vetan?

Yes! TDS calculations for perquisites are a part of Mool as per the Income Tax laws. We understand the importance of perquisites for an employee and employer.

Does Mool provide IT Return filing service ?

Yes, Mool offers assisted ITR ( Income Tax Return ) filing services for Individuals. A user can register with us and upload all the necessary documentation. With the help of our Tax Experts, your IT Returns are prepared and filed online.

When can I start filing IT Returns through Mool?

You can start filing your Income Tax Return through Mool anytime. Currently, the deadline for filing returns without penalty is over for FY 2022-23. However, you can register and create account with us for FY 2023-24. Soon, we will allow you to store your documents and investment proofs online and when the returns filing season opens up for AY 2024-25, you can start the filing process.

Where can I find step by step process of filing ITR ?

You can read through our blogs and articles where we have explained the step by step process of filing ITR online. Else, you can create an account with us and through an easy process and video guide, you can file your ITR. We also provide assisted ITR service. You can get in touch with us and with the help of a tax expert, we can help you file the IT Returns.

What other services and products does Mool offer?

Mool is a comprehensive SaaS platform offering personalized tax and financial planning solutions to individuals and enterprises. We provide various SaaS based services including Income Tax Filing and Tax & salary planning for individual taxpayers; Employee Payroll Automation, Salary Personalization and Compliance Audit for Enterprises and Client management platform for Tax Experts and finance professionals.