How Mool Vetan's Personalization Engine Saves Taxes

29 Jan, 2024

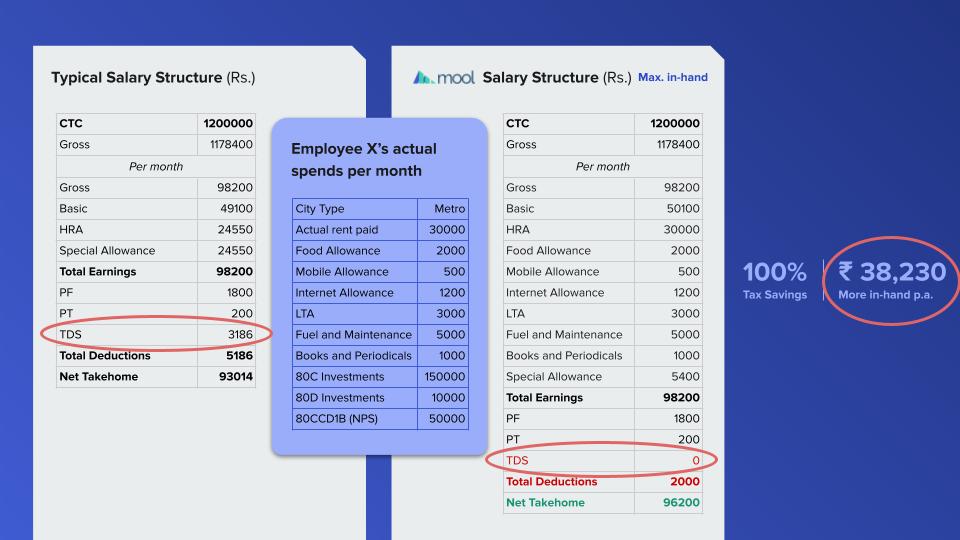

Mool Vetan is a proprietary product of Mool Finance that offers tax optimization via salary personalization. A SaaS offering, Mool Vetan easily integrates with all HRMS and payroll systems offering personalized salary structures that can save up to 45% in taxes and a 10% increase in take-home salary in the same CTC.

With the recent makeover of Vetan 2.0, the product is loaded with enhancements in the personalization engine, UI/UX, customizations, 3rd-party integrations, multi-level configuration (individual, group, organization), and more.

In this post, we cover the personalization engine and how it benefits employers and employees alike.

Ditching the cookie-cutter approach

Mool Vetan’s personalization engine offers an employee-first approach to salary and tax deductions. It analyzes the individual’s financial position and identifies relevant tax breaks and deductions.

Each employee benefits from a tax-optimized salary structure for both old and new tax regimes. Employees get to offer this perk keeping CTC the same.

Note: Unsure which tax regime would save you more? Try the old vs new regime comparison calculator.

Unified view for all parties

The personalization engine considers multiple aspects of individuals' investment options and consolidates them under one tab.

Unlike most systems that deal with tax-related data, Vetan form fields are jargon-free, in simple English terms, and clubbed under one tab for easy navigation.

The personalization engine builds on the data submitted by the users and makes appropriate recommendations.

Compliant with all tax laws

All recommendations made with Mool Vetan comply with India's tax and labor laws. The platform takes into consideration the central and state government jurisdictions over taxes and adapts to the latest labor law reforms.

Conclusion

Mool Vetan’s offering with the personalization engine is useful for employees across industries and tax slabs. It is available to businesses of all sizes - from startups to enterprises and costs less than a coffee cup in employee investment. Reduce the operational cost and save 5 man-days. Contact us today!

FAQs

How to calculate income tax on salary with example?

Income tax on salary can be calculated under the Old Tax Regime and the New Tax Regime. You can try the tax calculator to check the difference in your salary.

What is CTC in salary?

Cost to company (CTC) is the total amount spent on an employee including basic pay, variable pay, dearness allowance (DA), HRA, LTA, health care benefits, and other perks. Read in detail here.

What is gross salary?

Gross salary includes all direct benefits to an employee like EPF and gratuity but does not include taxes, insurance, or other benefits. Read in detail here.

What is DA in salary?

Dearness allowance paid to an employee combats inflations and the cost of living. Read in detail here.

How to negotiate salary with HR?

Salary negotiations are subject to skills, experience, and education. Keeping up to date with skills, updated resume, and good communication skills can help negotiate salary with HR.

Access exclusive content and expert tips by subscribing to our newsletter today!

Mool is a leading financial startup that aims to create a sustainable solution for corporate employees by facilitating effective tax planning, smart investments, insurance, and borrowing options. Mool simplifies the personal financial and taxation jargon and makes it accessible to all. With the products of Mool, organizations and employees can now maximize the value of their salaries without a hassle. Mool’s mission is to create a platform to educate everyone, optimize the growth of their money, and empower them with rich facts and proven analysis for decision making.